23.2.2009 | 13:37

The S&P 500 can fall another 42%.

Stock Market Volatility is Back: Approaching a Decade of Lost Returns on Investments. The S&P 500 can fall another 42%.

The stock market is off to a horrible start for 2009. Many thought that things could not get worse than what we experienced in 2008. Yet market volatility, a sign of an unhealthy economy, is still with us and appearing again in a ferocious way. From January 4, 2008 to February 21, 2008 the S&P 500 was off by -9.2%. The S&P 500 during that same time for 2009 is now off by -14.75%. The issues we will now face are a continuing stream of declining earnings because of the pullback in consumption and the tightening up of the credit markets. It also doesn’t help that consumers are psychologically more cautious because of what is going on.

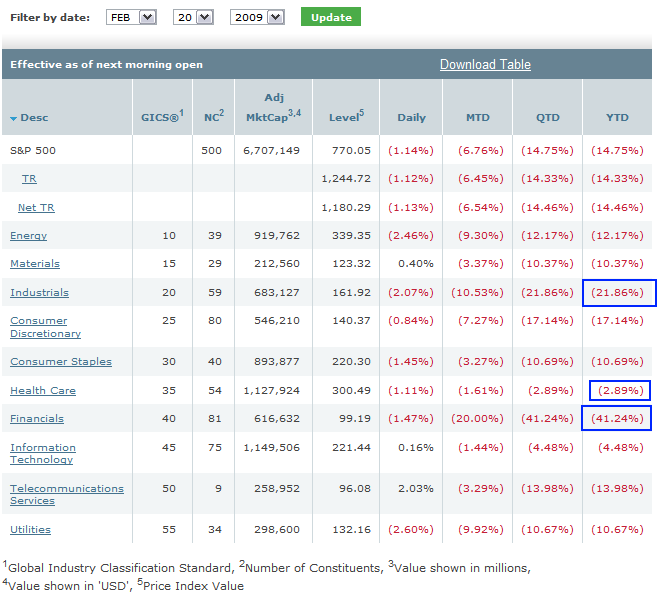

The S&P 500 hit a peak in October of 2007 at slightly over 1,560. At the peak, the S&P 500 had an adjusted market cap of $13.754 trillion. The current value of the S&P 500 is $6.7 trillion and the losses are across all industries:

The only sector that is not seeing double-digit losses is healthcare but even that, it is still down for the year. Of course, much of the downfall has occurred because of the pounding financials keep taking. The current level for financials is an adjusted 99.19. What was the level of financials back in the October 2007 peak? Try 475.86. What that means is the financial portion of the S & P 500 has fallen 79% in less than 2 years. Many other areas are also facing pain in the mean time. You don’t lose $7 trillion in market cap and expect other sectors to be fine.

Earnings for the S&P 500 have fallen off a cliff and are going to face their first quarterly loss since the Great Depression:

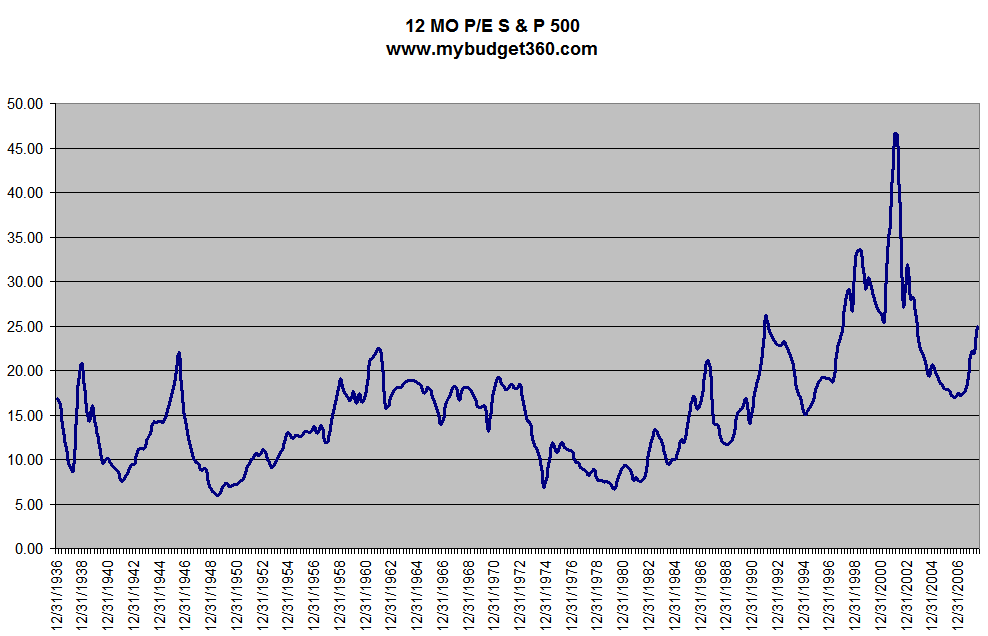

Consequently, the P/E ratio has increased in the past 2 quarters although I expect this to go down. Why has this occurred? Easy, prices have collapsed in line with earnings:

You need to remember how this ratio works. If earnings are increasing at the bottom and prices drop or stay steady, the P/E will have a smaller nominal value. This is good. It means the price of the stock is cheaper. But what is occurring even though the S & P 500 is off 50.6% from its peak value is that earnings have been tanking as well. So that is why in 2008 you see the P/E move up. This is somewhat counterintuitive but happens in most recessions. Take a look at the 2001 recession and the bubble peak. The P/E shot up to over 45 before bottoming out at 19.29 in 2004.

If we are to believe this is one of the worst and deepest recessions since World War II, we can expect prices to continue to fall. Now let us go back to the P/E chart above. During the 1940s the S&P 500 dropped to a P/E of 5.9 in 1949. We are nowhere remotely close to that and until we see the P/E at 10 or so, then we can assume a bottom (that is unless earnings start exploding to the upside which is not going to happen).

I ran a quick analysis and the average quarter earnings since 1940 is 15.79. We are still above that. So there is much more correcting to do.

Some are arguing that the fair value of the S&P 500 should be somewhere around 440 if we take a multiple of 15 which would be in line with historical P/E ratios. That is a stunning number but makes sense. That means the S&P would need to fall an additional 330 points, a drop of 42% from where we are currently at. That is hard to imagine yet the math points us in that direction.

Um bloggiš

Baldur Fjölnisson

Nżjustu fęrslur

- Torfi Stefįns bannašur ęvilangt

- OL ķ skįk. Landinn malaši Kenķu ķ 9. umferš

- OL ķ skįk: Landinn ķ 88. sęti eftir 8 umferšir

- Mešaljónar ķ skįkinni

- Baggalśtur - Sagan af Jesśsi

- Eitraš fyrir lżšnum?

- Óvenjulega döpur taflmennska innfęddra einkennir Reyjavķkursk...

- U.S. Rushes Coolant to Japanese Nuke Plant After Earthquake

Heimsóknir

Flettingar

- Ķ dag (12.9.): 1

- Sl. sólarhring: 1

- Sl. viku: 7

- Frį upphafi: 116495

Annaš

- Innlit ķ dag: 1

- Innlit sl. viku: 5

- Gestir ķ dag: 1

- IP-tölur ķ dag: 1

Uppfęrt į 3 mķn. fresti.

Skżringar

Bloggvinir

-

Agný

Agný

-

Alfreð Símonarson

Alfreð Símonarson

-

Andrea J. Ólafsdóttir

Andrea J. Ólafsdóttir

-

Bjarni Harðarson

Bjarni Harðarson

-

Bjarni Kjartansson

Bjarni Kjartansson

-

Björgvin Gunnarsson

Björgvin Gunnarsson

-

Brynjar Jóhannsson

Brynjar Jóhannsson

-

FLÓTTAMAÐURINN

FLÓTTAMAÐURINN

-

Eygló Þóra Harðardóttir

Eygló Þóra Harðardóttir

-

FreedomFries

FreedomFries

-

Fríða Eyland

Fríða Eyland

-

Félag um stafrænt frelsi á Íslandi

Félag um stafrænt frelsi á Íslandi

-

Georg P Sveinbjörnsson

Georg P Sveinbjörnsson

-

Gestur Guðjónsson

Gestur Guðjónsson

-

Gils N. Eggerz

Gils N. Eggerz

-

Gullvagninn

Gullvagninn

-

Gunnar Skúli Ármannsson

Gunnar Skúli Ármannsson

-

Guðrún María Óskarsdóttir.

Guðrún María Óskarsdóttir.

-

Gísli Hjálmar

Gísli Hjálmar

-

Hagbarður

Hagbarður

-

Halla Rut

Halla Rut

-

Haraldur Haraldsson

Haraldur Haraldsson

-

Hilmar Kári Hallbjörnsson

Hilmar Kári Hallbjörnsson

-

Hlekkur

Hlekkur

-

Ingibjörg Álfrós Björnsdóttir

Ingibjörg Álfrós Björnsdóttir

-

Jens Guð

Jens Guð

-

Jóhannes Ragnarsson

Jóhannes Ragnarsson

-

Jón Aðalsteinn Jónsson

Jón Aðalsteinn Jónsson

-

Jón Ragnarsson

Jón Ragnarsson

-

Jón Steinar Ragnarsson

Jón Steinar Ragnarsson

-

Jónína Benediktsdóttir

Jónína Benediktsdóttir

-

Karl Tómasson

Karl Tómasson

-

Kári Magnússon

Kári Magnússon

-

Loopman

Loopman

-

Magnús Þór Hafsteinsson

Magnús Þór Hafsteinsson

-

Promotor Fidei

Promotor Fidei

-

Rúnar Sveinbjörnsson

Rúnar Sveinbjörnsson

-

Salvör Kristjana Gissurardóttir

Salvör Kristjana Gissurardóttir

-

Sandra María Sigurðardóttir

Sandra María Sigurðardóttir

-

SeeingRed

SeeingRed

-

Sigurbjörn Friðriksson

Sigurbjörn Friðriksson

-

Sigurjón Þórðarson

Sigurjón Þórðarson

-

Sigurður Þórðarson

Sigurður Þórðarson

-

Snorri Hrafn Guðmundsson

Snorri Hrafn Guðmundsson

-

el-Toro

el-Toro

-

Sveinn Ingi Lýðsson

Sveinn Ingi Lýðsson

-

Tryggvi Hjaltason

Tryggvi Hjaltason

-

TómasHa

TómasHa

-

Túrilla

Túrilla

-

Upprétti Apinn

Upprétti Apinn

-

gudni.is

gudni.is

-

haraldurhar

haraldurhar

-

proletariat

proletariat

-

Ívar Pálsson

Ívar Pálsson

-

Ómar Ragnarsson

Ómar Ragnarsson

-

Ónefnd

Ónefnd

-

Óskar

Óskar

-

Óskar Helgi Helgason

Óskar Helgi Helgason

-

Óskar Þ. G. Eiríksson

Óskar Þ. G. Eiríksson

-

Þórir Kjartansson

Þórir Kjartansson

-

Arnar Guðmundsson

Arnar Guðmundsson

-

Bara Steini

Bara Steini

-

Birgir R.

Birgir R.

-

Birgir Rúnar Sæmundsson

Birgir Rúnar Sæmundsson

-

brahim

brahim

-

Brosveitan - Pétur Reynisson

Brosveitan - Pétur Reynisson

-

Bwahahaha...

Bwahahaha...

-

Dingli

Dingli

-

eysi

eysi

-

Gestur Kristmundsson

Gestur Kristmundsson

-

Guðbjörg Elín Heiðarsdóttir

Guðbjörg Elín Heiðarsdóttir

-

Gunnar Helgi Eysteinsson

Gunnar Helgi Eysteinsson

-

Gunnar Rögnvaldsson

Gunnar Rögnvaldsson

-

Helgi Jóhann Hauksson

Helgi Jóhann Hauksson

-

Hlini Melsteð Jóngeirsson

Hlini Melsteð Jóngeirsson

-

Jakobína Ingunn Ólafsdóttir

Jakobína Ingunn Ólafsdóttir

-

Katrín Snæhólm Baldursdóttir

Katrín Snæhólm Baldursdóttir

-

kreppukallinn

kreppukallinn

-

Kristín Magdalena Ágústsdóttir

Kristín Magdalena Ágústsdóttir

-

Máni Ragnar Svansson

Máni Ragnar Svansson

-

Morgunblaðið

Morgunblaðið

-

Neo

Neo

-

Orgar

Orgar

-

Ragnar L Benediktsson

Ragnar L Benediktsson

-

Rauði Oktober

Rauði Oktober

-

Skákfélagið Goðinn

Skákfélagið Goðinn

-

Sveinn Þór Hrafnsson

Sveinn Þór Hrafnsson

-

Vilhjálmur Árnason

Vilhjálmur Árnason

-

Þór Ludwig Stiefel TORA

Þór Ludwig Stiefel TORA

Athugasemdir

Žaš sem fer upp kemur alltaf nišur aftur. En žaš er hinsvega algjölega į móti nįttśrulögmįlinu aš žaš sem fari nišur komi upp aftur. Žvķ žurfum viš aš berjast į móti nįttśrulögmįlinu.

Offari, 23.2.2009 kl. 14:01

Megniš af hlutabréfamarkašnum hérna fór nišur ķ nśll og kemur ekki upp aftur. Ég tel vķst aš eins fari fyrir stęrstu hlutabréfamörkušum heims aš hlutir ķ gjaldžrota dęmum verši afskrifašir ķ hrönnum. Aušvitaš koma leifar žessarra markaša upp aftur einhvern tķma.

Baldur Fjölnisson, 23.2.2009 kl. 14:36

Jęja nśna ķ dag nįši DOW 12 įra lįgmarki. Og nśna kostar DOW 7,19 śnsur af gulli (toppinum var nįš ķ tęknibólunni žį kostaši DOW 43 śnsur)

Hvaš helduru aš dow eigi eftir aš lękka mikiš aš raunvirši, žaš er ķ gulli ?

http://goldnews.bullionvault.com/files/DowGoldRatio.png

eysi, 23.2.2009 kl. 23:22

Ekki gott aš segja, kannski 3-4000 ef ekkert veršur brįšasjįlfdautt af żmsum sjśklingum žarna ... annars gęti žaš fariš ķ 1-2000.

Žaš žarf aš skipta śt nokkrum lifandi lķkum, Alcoa, Bank of America, Citigroup, General Electric og General Motors og ašrir stokkar td. American Express, Walt Disney, Intel, JP Morgan, Microsoft og Pfizer žurfa aš afskrifa mikiš af hlutum til aš vera meš marktękt verš į hvern hlut. Ef td. MS afskrifaši 2/3 af sķnum yfirśtgefnu hlutum fęri verš į hlut ķ um 50 dollara. Komandi gjaldžrot į borš viš Alcoa og General Electric žurfa aš afskrifa amk. 80-90% af hlutafénu og sķšan reyna aš forša gjaldžroti meš śtgįfu nżrra hluta. Žaš er nįttśrlega snöggtum skįrra aš žynna hlutaféš śt meš verš į hlut 60-80$ en 6-8$.

Baldur Fjölnisson, 24.2.2009 kl. 13:47

Jį gulliš ... žaš į vķst aš vera vörn gegn veršbólgu og vķst er örvęntingarfull sešlaprentun ķ gangi vķša til aš vinna gegn veršhjöšnun sem fylgir hrynjandi skuldabólum. En heimurinn er aš drukkna ķ offramleišslugetu og staddur ķ hrošalegri tękni- og framleišnibyltingu sem engan veginn sér fyrir endann į. Žannig aš gķfurlega sterkir efnahagslegir kraftar vinna į móti veršbólguįhrifunum. Samt held ég almennt séš aš naušsynjavörur svokallašar muni hękka ķ verši į nęstu įrum en verš aftur hrynja į żmsum "óžarfa" möo. žvķ sem menn hafa veriš aš keppast viš aš kaupa fyrir peninga sem žeir įttu ekki til.

Ég efast um aš žaš sé einhver sérstakur skortur į gulli ķ heiminum. Žvķ meira sem žaš hękkar žvķ meiri hvati veršur aš grafa žaš śr jöršu, bręša skartgripi osfrv. Žaš er aftur aš reyna aš sperrast aš gagni upp śr 1000$ og kannski tekst žaš nśna, kemur ķ ljós. En eins og ég sagši žį eru verulegir veršhjöšnunarstraumar ķ gangi allavega ķ żmsum hlutum og mįlmar ęttu aš vera žar į mešal.

Baldur Fjölnisson, 24.2.2009 kl. 13:59

"Black Swan" author Nassim Taleb says the US banking system is 'designed to blow up'

Baldur Fjölnisson, 24.2.2009 kl. 15:58

Bęta viš athugasemd [Innskrįning]

Ekki er lengur hęgt aš skrifa athugasemdir viš fęrsluna, žar sem tķmamörk į athugasemdir eru lišin.